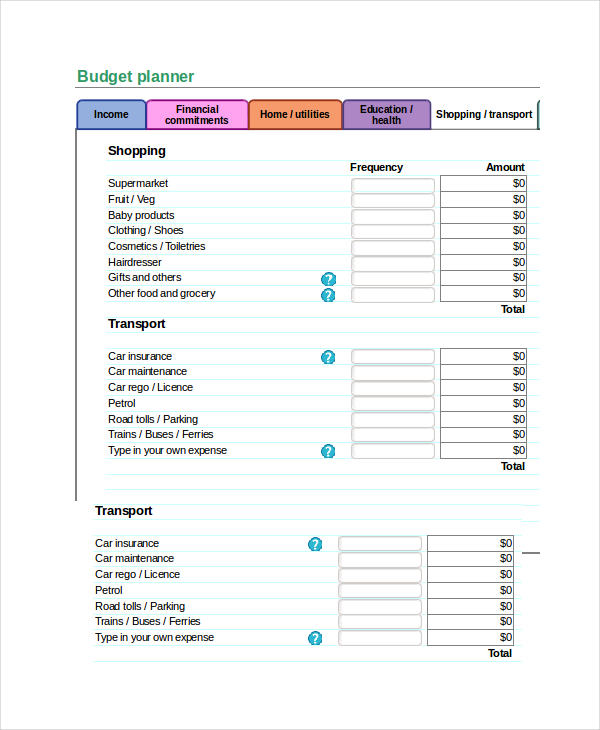

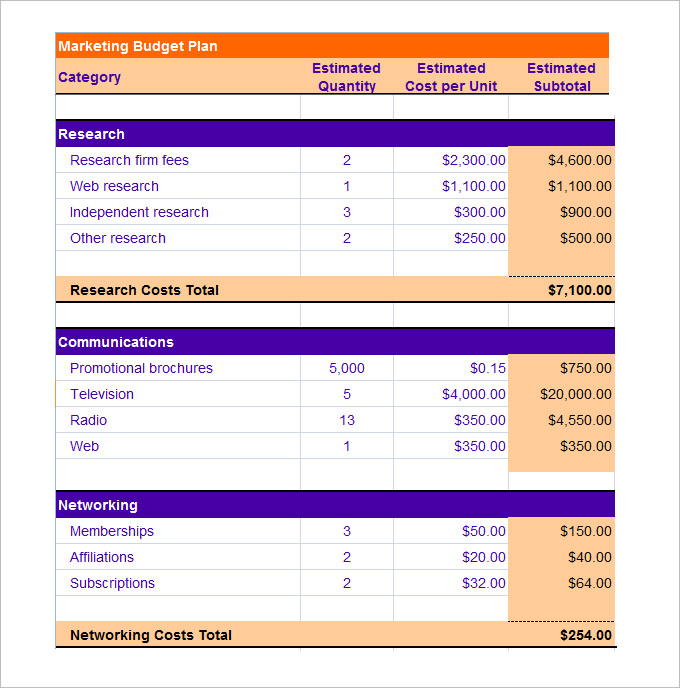

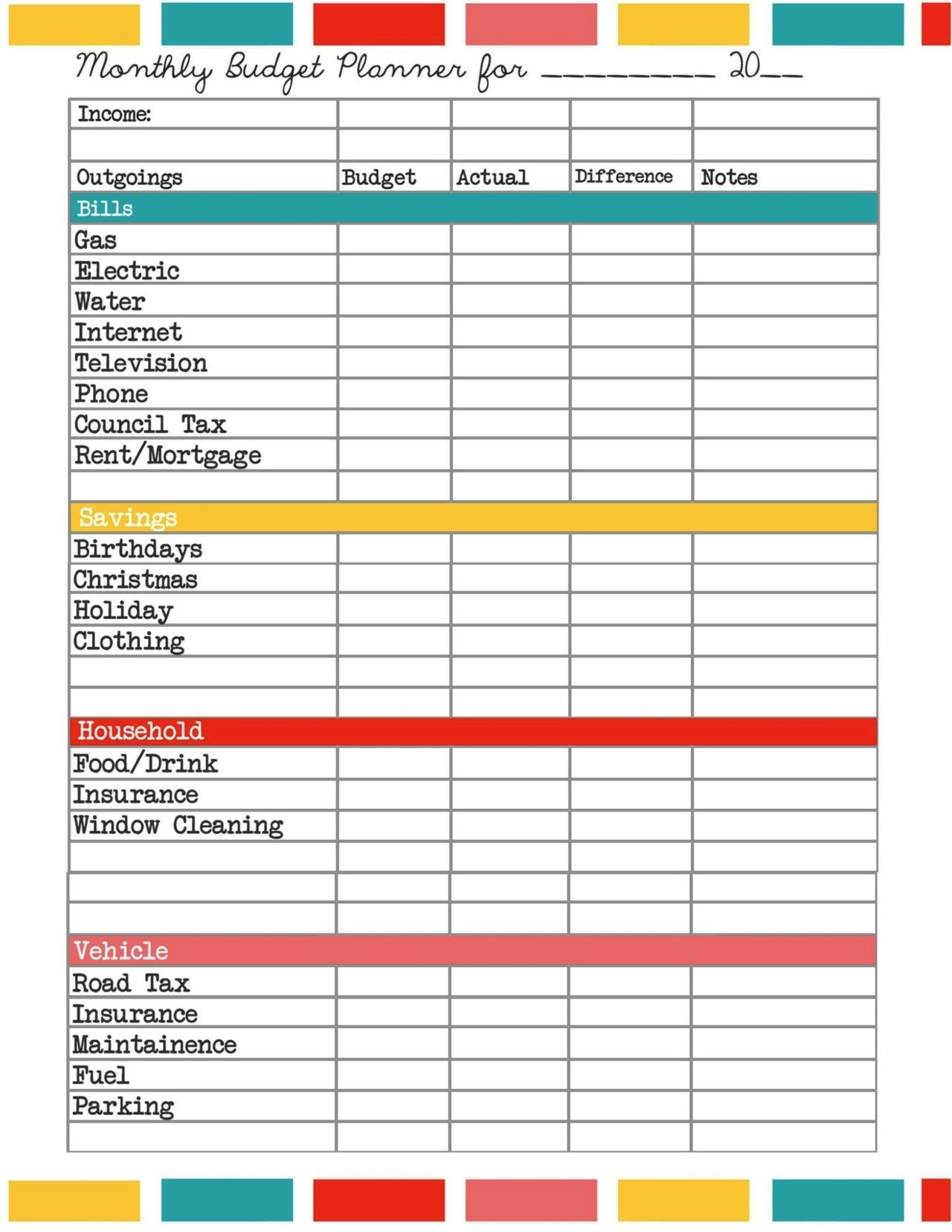

With that, I’ve created a sample budget below based on a $46,000 annual post-tax salary to help you visualize a starting point for your budget.īelow are some example categories of expenses and estimated costs as well as an overview of each expense that could be added to a spreadsheet. One of the best ways to learn about budgeting is to take a look at an example budget. With a solid budget in place, you may find that you have more peace of mind as you navigate your finances. Plus, a budget can ensure that you have enough money to stretch until the next payday. Essentially, it can help you with the habit of prioritizing your wants vs needs. Beyond helping you accomplish long-term financial goals, you can use budgeting as a means to keep spending money on the things that matter to you most. If you are wondering why you should create a budget, the main reason is that it can help you stay on track towards financial goals. This can be incredibly helpful to avoid forgotten expenses that can throw off your budget. With that, I’m sharing a sample budget to make sure you can include everything the first time around. When I first started budgeting, I learned a lot from other example budgets of what should be included. With a better picture of what others are including in their budget, you can make sure you aren’t leaving anything out. To speak with an investment expert contact us at 60 or toll-free at 1-888-Vancity (826-2489), visit your local branch or in your neighbourhood.When you are working to get your finances on track, it can be helpful to see an example of a budget. It doesn't factor in non-financial considerations that can result from drastic changes in spending habits. And remember, a budget is only a guideline. Once your budget is done, things are bound to change. Compare your actual expenses and income to your budget and make appropriate adjustments. Track your progressĪt the end of each month, you should re-evaluate your budget. Our Jumpstart® is specially designed for these types of savings plans. You can set up a separate savings account for infrequent but anticipated expenses, such as property taxes, vacations, automobile insurance or car maintenance. When you pay yourself first you simply set aside a certain amount of money each month to go into an account that you will not touch. Once you've figured out how much money is coming in and where it's going, you can put together a plan that matches your goals with your financial situation. Or they can be short-term goals such as home improvements or car maintenance. These can be long-term goals like purchasing property or funding your retirement. Set goalsĮstablish a list of the goals you wish to achieve. Once you see your spending patterns, you may be able to make adjustments to certain expenses.

If your records aren't clear, consider keeping a financial diary to track your spending.īe sure to separate the fixed expenses that you must meet (mortgage, rent, car payments, insurance) from variable expenses (food, clothing, entertainment, charitable gifts). Next you need to determine how you spend your money by reviewing your financial records. This might be investment income, government assistance, student loans, employment income, disability benefits, retirement pensions or money from other sources. The first step is to calculate how much money you have coming in each month. If you're ready to roll up your sleeves and crunch some numbers, here are six steps to get you on your way. And it will even help you spot areas where you can save some money. While there are more exciting things to do in life, a budget is still the best way for you to get a handle on ways to save money. Let's face it, doing a household budget can be pretty dull.

0 kommentar(er)

0 kommentar(er)